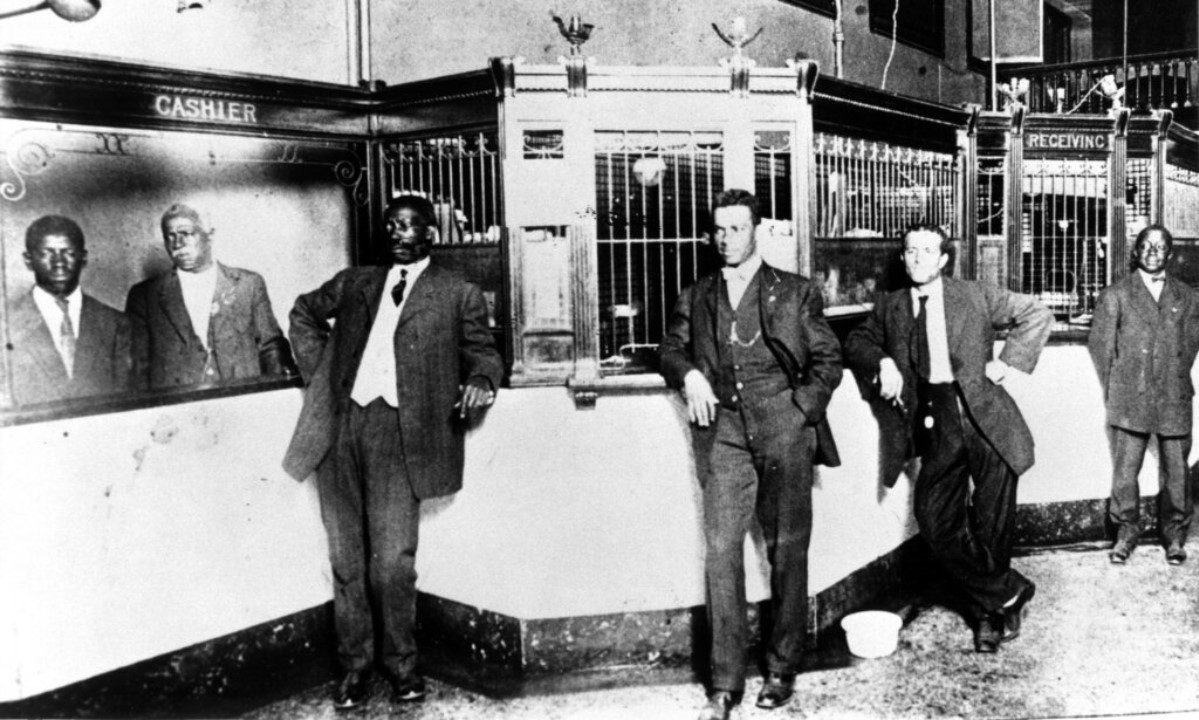

The establishment of the Penny Savings Bank in 1890 marked a pivotal moment in the economic empowerment of African American communities. Founded by Reverend William Reuben Pettiford, it stood as the first black-owned and black-operated financial institution in Alabama.

With a clear focus on fostering the growth of black businesses and promoting savings among African Americans, the bank rapidly gained traction, drawing deposits and expanding its footprint across multiple branches.

Notably, Pettiford's strategic partnerships with white financial institutions underscored his dedication to self-reliance and racial solidarity, ultimately contributing to the bank's stability and success.

His influence extended beyond the bank's operations, as he played a crucial role in organizing the National Negro Bankers Association and advocating for the establishment of black-owned banks nationwide.

Despite its eventual merger and closure, the legacy of the Penny Savings Bank endures, leaving a lasting impact on the economic advancement and financial literacy of African American communities.

Key Takeaways

- The Penny Savings Bank, founded in 1890 by Reverend William Reuben Pettiford, was the first black-owned and black-operated financial institution in Alabama.

- The bank aimed to support the development of black businesses and encourage savings among African Americans, inspired by Pettiford's experience as a financial agent and the influence of Booker T. Washington.

- The Penny Savings Bank achieved significant growth and success, with deposits increasing from $78,124.21 in July 1902 to $421,596.51 in October 1911. It emphasized homeownership and facilitated real estate transactions for economic growth.

- Collaboration with white financial institutions played a crucial role in the stability and success of the Penny Savings Bank. Pettiford established working relationships with white bankers and received assistance from Birmingham's white financial institutions for training and support.

Establishment of Penny Savings Bank

Establishing itself in 1890, the Penny Savings Bank was founded by Reverend William Reuben Pettiford, marking the beginning of the first black-owned and black-operated financial institution in Alabama.

Its establishment was of immense importance as it aimed to provide financial support for the development of black businesses and to promote savings within the African American community.

The influence of the Penny Savings Bank was profound, as it was motivated by Pettiford's experience as a financial agent and the inspiration of Booker T. Washington.

By choosing to establish the bank with the collaboration of local black leaders instead of relying on external support, Pettiford set a precedent for self-sufficiency and community empowerment.

The bank's influence extended far beyond its initial creation, laying the foundation for future black-owned banks and the economic advancement of African American communities.

Growth and Expansion

The Penny Savings Bank's growth and expansion were marked by the establishment of branches in Selma, Anniston, and Montgomery. This expansion facilitated increased access to financial services for African American communities, contributing to their financial stability and economic development.

The bank's deposits grew significantly, from $78,124.21 in July 1902 to $421,596.51 in October 1911, reflecting the growing trust and participation of the community.

Moreover, the bank emphasized homeownership and facilitated real estate transactions, further stimulating economic growth within the African American community.

Additionally, the establishment of branches in strategic locations enabled the bank to reach a wider demographic, fostering economic development and financial empowerment.

The expansion of the Penny Savings Bank played a pivotal role in promoting financial stability and economic advancement for African Americans during this period.

Collaboration With White Institutions

The Penny Savings Bank's collaboration with white financial institutions was instrumental in fostering its stability and success, facilitating its growth and expansion into new regions. This collaborative partnership with white bankers exemplified racial solidarity and contributed to the bank's ability to weather economic challenges.

The bank received crucial assistance from Birmingham's white financial institutions for training and support, demonstrating how collaborative partnerships can transcend racial barriers for the collective benefit of the community. Furthermore, administrative help from Steiner Brothers Bank played a pivotal role in helping the Penny Bank survive the economic crisis of 1893, highlighting the importance of cross-racial cooperation in achieving common goals.

Pettiford's strategic collaboration with powerful whites not only aided the bank's stability and success but also exemplified the potential for mutual support and understanding between different racial groups.

National Negro Bankers Association

Pettiford's leadership and influence extended beyond the Penny Savings Bank's operations, as evidenced by his pivotal role in organizing the National Negro Bankers Association in 1906. Serving as its president until his death, Pettiford became the leading figure in the African American bank movement, traveling throughout the South to assist in establishing black-owned banks.

His efforts fostered the establishment and support of black-owned banks, contributing to African American financial empowerment. The association played a crucial role in empowering African American communities economically, as it sought to provide financial resources and opportunities for African American businesses and individuals.

Through his involvement in the National Negro Bankers Association, Pettiford solidified his legacy as a driving force behind the African American bank movement, leaving a lasting impact on the financial empowerment of African Americans.

Closure and Legacy

After merging with Prudential Savings in 1915, the Penny Savings Bank became the Alabama Penny-Prudential Savings Bank.

Closure Impact

The bank failed less than a year after Reverend Pettiford's death, as his unique relationships with larger banks were absent. Forced liquidation of assets and the sale of the building to the Knights of Pythias had a significant impact on the local community.

Financial Education

Its closure highlighted the importance of financial education and proper resource management for African Americans. The bank's legacy emphasized the need for continued financial education and empowerment within the community.

Overall Contribution

Despite its closure, the bank contributed to the ownership of homes, churches, and businesses in Birmingham, leaving a lasting impact on the economic development of the region.

Impact on African American Empowerment

Reverend William Reuben Pettiford's establishment of the Penny Savings Bank had a significant impact on African American empowerment, providing a vital financial resource for the community. The bank played a crucial role in fostering economic advancement and promoting financial literacy among African Americans. By encouraging savings and homeownership, the bank empowered individuals to take control of their financial futures and invest in their communities.

Furthermore, Pettiford's collaboration with white financial institutions not only ensured the bank's stability but also demonstrated the importance of building strategic partnerships to achieve economic empowerment. His leadership in organizing the National Negro Bankers Association and supporting the establishment of black-owned banks across the South further exemplified his commitment to advancing the economic interests of African Americans.

The legacy of the Penny Savings Bank continues to inspire and educate future generations about the importance of financial empowerment within the African American community.

Frequently Asked Questions

What Were the Specific Challenges Faced by Reverend William Reuben Pettiford in Establishing the Penny Savings Bank in 1890?

Reverend William Reuben Pettiford faced significant challenges in establishing the Penny Savings Bank in 1890, including financial obstacles and the need to garner support from the community. Despite these hurdles, the bank provided empowerment lessons and made a substantial impact on the African American community.

How Did the Penny Savings Bank Contribute to the Economic Growth and Development of African American Communities in Alabama?

The Penny Savings Bank significantly contributed to the economic empowerment and community development of African American communities in Alabama. It facilitated homeownership, real estate transactions, and the growth of black businesses, fostering financial stability and self-reliance.

What Were Some of the Key Strategies Used by Pettiford to Establish Working Relationships With White Financial Institutions, and How Did These Relationships Benefit the Penny Savings Bank?

To establish relationships with white financial institutions, Pettiford emphasized self-help and racial solidarity, aligning with Booker T. Washington's philosophy. Collaboration with powerful whites aided the Penny Savings Bank's stability, financial empowerment, and contribution to economic growth within African American communities.

What Were the Main Goals and Initiatives of the National Negro Bankers Association, and How Did Pettiford Contribute to Its Success?

The National Negro Bankers Association aimed to bolster African American financial institutions. Pettiford's leadership enhanced its goals, facing challenges like merging with white-owned banks. His legacy fostered financial empowerment and collaboration, teaching valuable lessons in managing resources.

In What Ways Did the Closure of the Penny Savings Bank Impact the African American Community in Birmingham, and What Lessons Were Learned From Its Failure in Terms of Financial Management and Empowerment?

The closure of Penny Savings Bank had a significant impact on the African American community in Birmingham, highlighting the importance of sound financial management. Lessons learned underscored the necessity of community empowerment through proper resource allocation and investment strategy.

Conclusion

In conclusion, the Penny Savings Bank, established in 1890 by Reverend William Reuben Pettiford, played a pivotal role in advancing the economic empowerment and financial literacy of African American communities.

Its growth, strategic collaborations, and national advocacy efforts left a lasting impact on the development of black-owned banks and businesses.

Despite its eventual closure, the legacy of the Penny Savings Bank endures as a symbol of self-help and racial solidarity, embodying the resilience and strength of African American entrepreneurship.

Our Reader’s Queries

What was unique about the Alabama Penny Savings Bank?

The Alabama Penny Savings Bank, established in 1890, was the first bank owned by black individuals in Alabama. It provided financial support for the building of homes and churches for many black residents in the local community. By 1907, it had become the second largest black-owned bank in the entire United States.

What is a penny savings bank?

Established in Birmingham in 1890 by Reverend William Reuben Pettiford, The Penny Savings Bank made history as Alabama’s inaugural black-owned and black-operated financial institution. It later expanded to include branches in Selma, Anniston, and Montgomery.

What happened to the St Luke Penny Savings bank?

Founded in 1903, the St. Luke Penny Savings Bank is now known as the Consolidated Bank & Trust. This name change came about after a merger with two smaller black-owned banks in 1930.

What did the bank offer to African Americans?

Banks and insurance companies catering specifically to the black community arose due to the exclusion of African Americans from traditional financial institutions. These businesses not only offered credit and insurance but also played a crucial role in fostering economic growth, employment, and skill development within their communities.

Check Out For More References