Enviva Bankruptcy Doesn’t Halt Alabama Plant: Despite the recent bankruptcy filing by Enviva, the biomass energy giant, the $375 million Alabama plant project appears to be moving forward. This development raises questions about the resilience of the renewable energy sector amidst financial challenges.

Enviva’s ability to navigate its debt restructuring while continuing with its expansion plans underscores the complexities of the biomass energy industry and its role in the ongoing debate surrounding sustainable energy sources.

The implications of this situation extend beyond Enviva’s immediate future, prompting a closer examination of the broader implications for renewable energy initiatives.

Enviva’s Bankruptcy Filing and Construction Plans

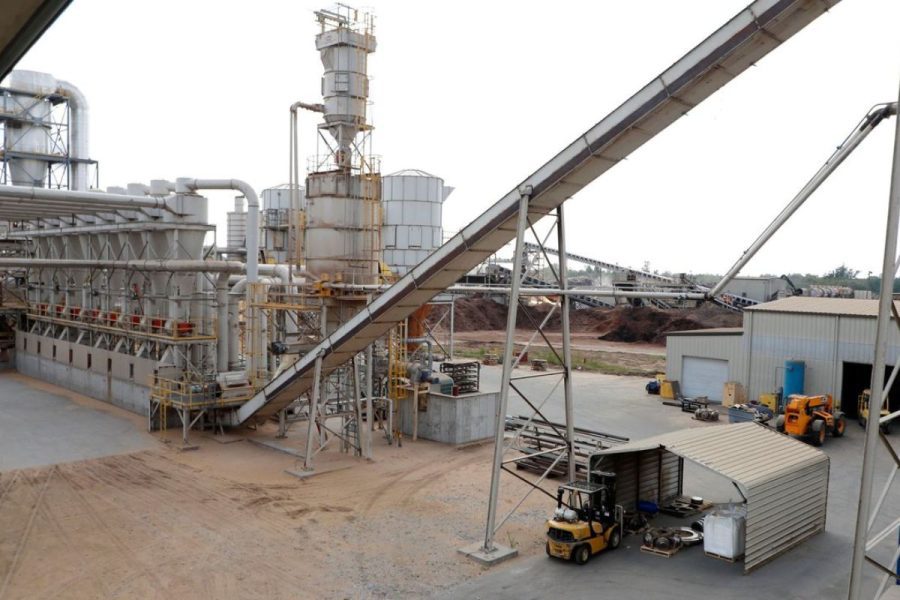

Enviva’s strategic decision to file for bankruptcy while maintaining its commitment to the construction of the $375 million pellet mill in Alabama showcases a deliberate approach towards financial restructuring and operational continuity. By filing for Chapter 11 bankruptcy, Enviva aims to reduce its debt burden significantly, amounting to around $1 billion, to enhance profitability and secure a sustainable future for the business. Despite the bankruptcy filing, the company’s pledge to continue building the pellet mill in Sumter County signifies a strong belief in the long-term viability of the project and the strategic importance of expanding its production capacity.

The construction of the new facility in Epes, Alabama, which began in 2023, is a crucial part of Enviva’s growth strategy to solidify its position as a leading wood pellet producer globally. The decision to proceed with the construction under the bankruptcy plan demonstrates Enviva’s commitment to honoring its obligations while concurrently implementing necessary financial adjustments to ensure operational resilience and competitiveness in the biomass energy market.

Financial Challenges and Debt

Amidst mounting financial challenges and overwhelming debt obligations exceeding $2.6 billion, Enviva finds itself navigating a precarious fiscal landscape fraught with uncertainties and strategic complexities. The company’s debt includes $780 million to a Delaware bank, $348 million to a German energy company, and $353 million in bonds from local development authorities in Mississippi and Alabama. Enviva’s recent struggles culminated in a missed $24.4 million interest payment in January, signaling impending bankruptcy proceedings.

Over the past 15 months, Enviva has faced significant financial turmoil, with its stock price plummeting from $61.99 per share in November 2022 to a mere $0.35 on Thursday. The company attributes its financial woes to ill-fated long-term deals made in 2022, where it committed to purchasing wood pellets in anticipation of rising market prices that failed to materialize.

Enviva’s financial challenges and staggering debt burden pose substantial hurdles as the company seeks to navigate its way through a turbulent period of uncertainty and financial distress.

ALSO READ: Council President Reconsiders Fate of Bridge: Will It Be Saved?

Debate Over Biomass Energy

The ongoing debate surrounding biomass energy centers on its effectiveness in reducing carbon emissions and its alignment with global clean energy objectives.

Enviva’s production of wood pellets for biomass energy raises concerns among critics who doubt its contribution to mitigating climate change. While the European Union and some Asian nations subsidize the shift from coal to wood pellets to meet clean energy targets, skeptics argue that biomass energy does not significantly decrease carbon emissions. They contend that the subsidies allocated to biomass energy could be more efficiently utilized in promoting truly renewable energy sources.

Advocates of biomass energy, on the other hand, defend its use by highlighting that burning wood releases only recently captured carbon, in contrast to the ancient carbon released from fossil fuels. This distinction underscores a key point of contention in the biomass energy debate, emphasizing the need for a comprehensive assessment of its environmental impact and its role in the transition to a sustainable energy future.

News in Brief

Enviva’s bankruptcy filing doesn’t halt $375M Alabama plant construction, spotlighting renewable energy’s resilience. The biomass giant’s commitment to the project amidst financial challenges raises questions about the sector’s future. Enviva’s strategy aims to reduce debt while expanding production capacity, emphasizing long-term viability.

However, the company faces significant financial hurdles, including a missed interest payment and plummeting stock prices. The debate over biomass energy’s effectiveness in reducing carbon emissions continues, with critics questioning its environmental impact. Advocates argue for its role in transitioning to clean energy, highlighting the distinction between burning wood and fossil fuels.