Alabama House Sparks Workforce Revolution: The recent legislative actions undertaken by the Alabama House of Representatives have set the stage for a transformative shift in the state’s workforce landscape. With the passage of the ‘Working for Alabama’ Workforce Bills, significant changes have been put into motion to address longstanding barriers to workforce participation.

These bills, encompassing measures such as the Alabama Workforce Housing Tax Credit and Employer Child Care Tax Credits, signal a proactive approach towards bolstering economic growth and fostering a more inclusive workforce environment. The implications of these legislative steps are poised to reshape the workforce dynamics in Alabama, ushering in a new era of opportunities and progress.

Alabama House Passes “Working for Alabama” Workforce Bills

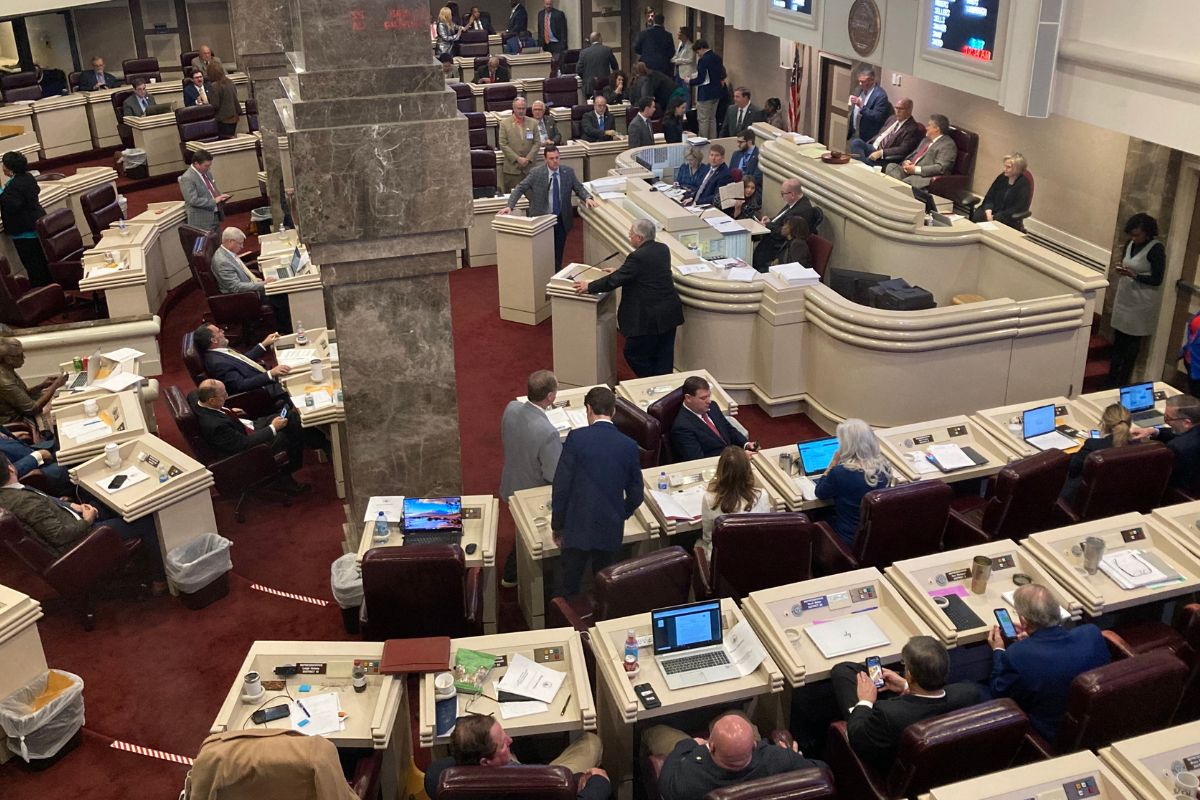

The Alabama House of Representatives decisively passed the ‘Working for Alabama’ Workforce Bills, signaling a significant step towards addressing the state’s workforce participation challenges. Governor Kay Ivey‘s initiative gained traction as lawmakers recognized the pressing need to boost workforce engagement despite the state’s record-low unemployment rates. The bipartisan support for these bills underscores a shared commitment to tackling Alabama’s workforce issues head-on.

By approving this legislation, the Alabama House has set the stage for a potential workforce revolution in the state. The bills aim to remove barriers that hinder individuals from entering or rejoining the workforce, fostering a more thorough and inclusive labor market. Through targeted measures and strategic initiatives, these bills lay the foundation for a more vibrant and dynamic workforce landscape in Alabama.

As the state grapples with persistent workforce participation challenges, the passage of the ‘Working for Alabama’ Workforce Bills represents a pivotal moment in the effort to revitalize and strengthen Alabama’s labor force. This legislative milestone sets the tone for thorough reforms that prioritize workforce development and economic prosperity.

HB346: Alabama Workforce Housing Tax Credit

Introduced by Rep. Cynthia Almond, R-Tuscaloosa, HB346 proposes the establishment of the Alabama Workforce Housing Tax Credit, aiming to incentivize developers to build affordable housing for individuals entering or rejoining the labor force.

This tax credit program is designed to address the housing needs of those starting employment and will be administered by the Alabama Housing Finance Authority. By providing developers with incentives to build affordable housing units, the bill seeks to support workforce participation by ensuring access to suitable accommodation.

The unanimous support for HB346 in the House, passing with a vote of 103-0, underscores the recognition of the importance of affordable housing in facilitating workforce engagement. Through this initiative, Alabama is taking a proactive step towards enhancing opportunities for individuals seeking to enter or re-enter the labor market by alleviating the financial burden associated with housing.

The Alabama Workforce Housing Tax Credit aligns with broader efforts to promote economic growth and workforce development in the state.

ALSO READ: Alabama House Approves Child Care Tax Credit Bill

HB358: Employer Child Care Tax Credits

House Minority Leader Anthony Daniels, D-Huntsville, champions HB358, which aims to alleviate the burden of childcare costs for workers through employer child care tax credits. This bill, sponsored by Daniels, offers tax incentives to employers who provide childcare facilities for their employees. Additionally, it extends these tax credits to specific childcare providers, with the overarching goal of enhancing accessibility and affordability of high-quality childcare services. The bipartisan backing of HB358 signifies a shared understanding of the substantial impact that affordable childcare has on workforce engagement and retention.

The unanimous approval of HB358 in the House, with a vote of 103-0, underscores the widespread acknowledgment of the importance of addressing childcare challenges to bolster workforce participation. By incentivizing employers to invest in childcare support, this bill not only eases the financial burden on working families but also contributes to a more productive and engaged workforce. HB358 represents a proactive step towards creating a more supportive environment for working parents and enhancing overall workforce dynamics in Alabama.

SB247: Department of Workforce Consolidation

With SB247, Alabama advances towards optimizing workforce development through a strategic consolidation of efforts under a unified agency.

The bill, passed with an overwhelming vote of 102-0, aims to streamline workforce development by merging various initiatives into a single entity.

Under SB247, the Alabama Department of Labor will undergo a name change to the Department of Workforce and will undergo other organizational adjustments to improve efficiency and coordination in tackling workforce challenges.

By centralizing these functions, the state anticipates a more cohesive approach to addressing the needs of both employers and employees, ultimately fostering a more robust and adaptable workforce.

This consolidation is seen as a proactive step towards enhancing the state’s competitiveness and readiness in the ever-evolving labor market.

Governor Ivey’s pending signature on SB247 signifies a significant milestone in Alabama’s commitment to bolstering its workforce development infrastructure for the benefit of all stakeholders involved.

News in Brief

The Alabama House of Representatives has made significant strides towards enhancing workforce development and economic growth through the passage of the ‘Working for Alabama’ Workforce Bills.

The bipartisan support for initiatives like the Alabama Workforce Housing Tax Credit, Employer Child Care Tax Credits, and Department of Workforce Consolidation demonstrates a collective effort to address critical workforce challenges and create a more inclusive and productive workforce environment in the state.