Alabama House Passes Bill Limiting Property Tax: The recent passage of Alabama’s Property Tax Cap Bill by the state’s House of Representatives marks a pivotal moment in property tax regulations. With overwhelming bipartisan support, the bill’s 7% annual limit on property value increases addresses the pressing concerns of homeowners grappling with rising tax burdens.

The strategic amendments and provisions within the legislation reveal a nuanced approach to property tax reform. As the bill advances, it prompts a deeper examination of the impact on homeowners, local economies, and the broader implications for fiscal policy.

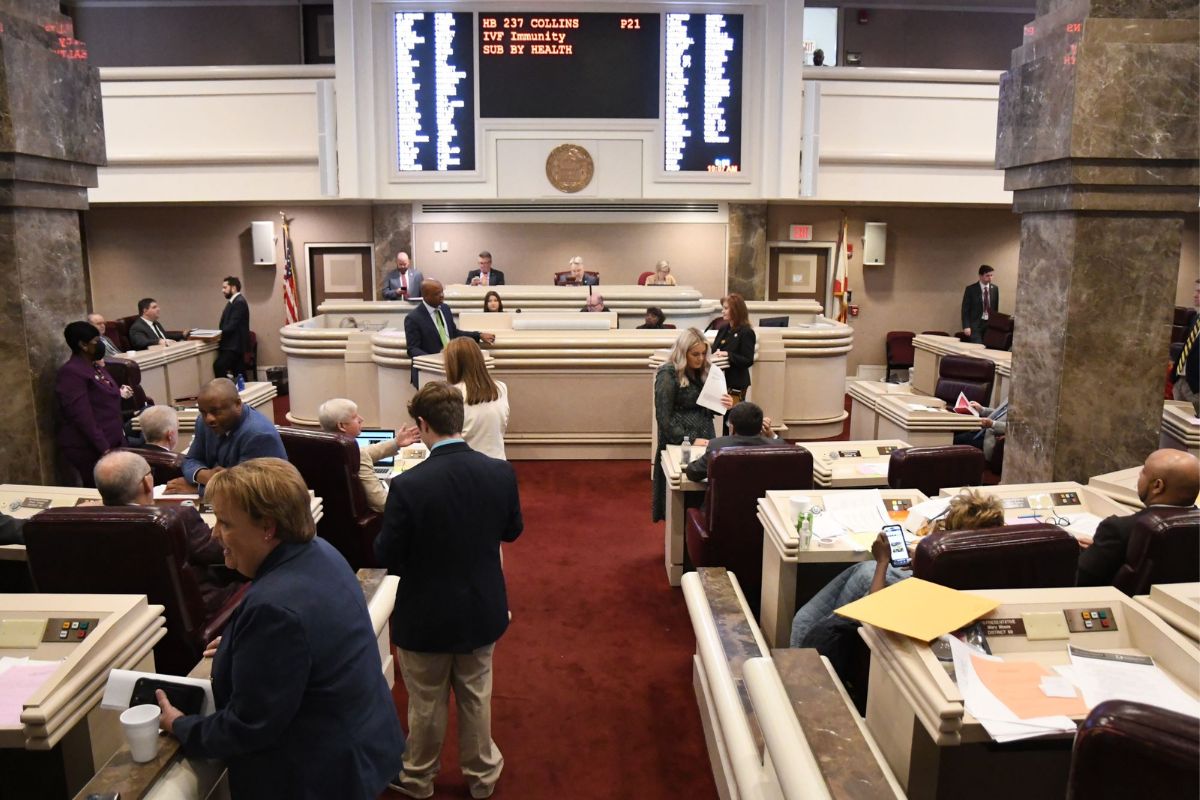

House Approval of Property Tax Cap Bill

The legislative milestone of the Alabama House of Representatives approving the Property Tax Cap Bill, known as HB 73, signifies a significant step towards implementing constraints on property tax increases within the state. Sponsored by Rep. Philip Pettus, the bill garnered overwhelming support with a 97-1 vote, showcasing a strong bipartisan agreement on the need for property tax reform.

HB 73 specifically aims to limit annual increases in assessed property values to a maximum of 7%, providing relief to homeowners who have faced escalating property tax bills in recent years. This measure reflects a proactive approach by state lawmakers to address concerns about rising property taxes, ensuring that future increases are moderate and predictable for Alabama residents.

The broad approval of this bill underscores the urgency and importance attached to the issue of property tax hikes in the state, setting the stage for further discussions and actions to safeguard property owners from excessive tax burdens.

Details of the Bill and Amendments

How have the amendments to HB 73 impacted the proposed caps on property tax increases in Alabama?

Originally, HB 73 suggested a 3% cap for residential properties and a 5% cap for commercial properties. However, Representative Pettus proposed amendments that aligned both caps at 7%, affecting both residential and commercial properties. These amendments signify a significant change from the initial proposal, aiming to provide consistency and fairness across property types.

Moreover, the bill includes specific exemptions for properties that have undergone renovations, new constructions, or changes in ownership within families. This guarantees that properties undergoing significant changes are not unfairly constrained by the caps. Additionally, a provision for review and assessment has been included in the bill, leading to the repeal of the cap in 2029. The Alabama Department of Revenue and the Alabama Ad Valorem Advisory Committee will play vital roles in evaluating the cap’s impact on property values, providing recommendations to the relevant state authorities based on their findings.

Legislative Debate and Amendments

Following the amendments proposed by Representative Pettus to align the caps on property tax increases at 7% for both residential and commercial properties in Alabama, the legislative debate continued with Rep. Jim Hill advocating for a sunset provision and avenues for property owners to contest tax raises. Rep. Hill’s proposal aimed to introduce a time limit on the legislation, ensuring a review of its effectiveness in the future. Additionally, he emphasized the importance of providing property owners with mechanisms to challenge tax hikes they deemed unfair, suggesting the option to appeal decisions in circuit court.

However, Hill’s suggestion to restrict the cap’s application solely to revenue directed to the state was set aside. Moreover, his subsequent amendment, which sought to grant counties experiencing significant population growth the ability to enforce the cap, was also not incorporated into the final version of the bill. The discussions surrounding these proposals added layers of complexity to the legislative process, reflecting the nuanced considerations involved in property tax regulation.

ALSO READ: House Judiciary Stirs Controversy Over Medical Parole Bill

Responses and Perspectives

Amidst the evolving discourse surrounding Alabama’s property tax legislation, a spectrum of responses and perspectives from key stakeholders has emerged, shedding light on the diverse viewpoints shaping the ongoing debate.

State Schools Superintendent Eric Mackey expressed contentment with the amended 7% cap, considering it equitable for school districts statewide. In contrast, Rep. Brett Easterbrook voiced his support for the bill, emphasizing concerns about the potential burden of steep property tax hikes on families and advocating for the complete elimination of property taxes. These contrasting viewpoints underscore the complexity of the issues at hand and the varying interests involved in the proposed legislation.

As HB 73 progresses to the Senate for further deliberation, the perspectives of Mackey and Easterbrook reflect broader debates within the community regarding the balance between property tax regulations, funding for essential services like education, and the financial well-being of residents. The divergent opinions signal a need for thorough examination and discussion to navigate the intricate landscape of property tax policy in Alabama.

News in Brief

The passage of the Property Tax Cap Bill by the Alabama House of Representatives reflects a bipartisan effort to address the concerns of homeowners facing rising property tax bills.

The amendments made to the bill demonstrate a thoughtful approach to property tax regulation, with provisions for exemptions and a potential cap repeal in 2029.

This legislation signifies a proactive step by state lawmakers to control property tax hikes and provide relief to taxpayers.